Hyderabad-based Vidyut Vinayak is a 31-year-old

programmer who earns Rs 2.2 lakh a month. He lives with his wife, who will

start working soon. They live in their own house worth Rs 67.5 lakh, for which

Vinayak has taken a loan of Rs 53.7 lakh and is paying an EMI of Rs 37,232. He also has a car loan for which he is paying an EMI

of Rs 10,385. Vinayak is left with a surplus of Rs 91,955 every month and

Hyderabad-based Vidyut Vinayak is a 31-year-old programmer who earns Rs 2.2

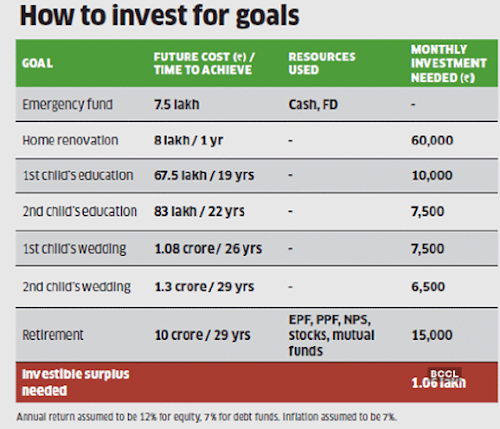

lakh a month His goals include building

an emergency corpus, home renovation, saving for his future children’s

education and weddings, and his retirement.

Financial Planner Pankaaj Maalde suggests that

Vinayak start by repaying his car loan of Rs 4.3 lakh with the cash in bank. He

should then build an emergency corpus of Rs 3.5 lakh, which is equal to three

months’ expenses, and a medical buffer of Rs 4 lakh for his parents. He can do

so by investing his remaining cash and fixed deposit in a liquid fund. For home renovation in a year, Vinayak

will need Rs 8 lakh and can save the surplus of Rs 60,000 in a liquid fund for

this period.

To amass Rs 67.5 lakh for his future child’s education

in 19 years, he will have to start an SIP of Rs 10,000 in a diversified equity

fund. For the second child’s education in 22 years, he has estimated a need of

Rs 83 lakh and can build the corpus by starting an SIP of Rs 7,500 in a

diversified equity fund. For the first child’s wedding in 26 years, he needs Rs

1.08 crore and can build it by starting an SIP of Rs 6,000 in a diversified

equity fund and Rs 1,500 in the gold bond scheme.

Similarly,

for the second child’s wedding, he needs Rs 1.3 crore in 29 years. He will have

to start an SIP of Rs 5,000 in a diversified equity fund and Rs 1,500 in the

gold bond scheme to achieve this goal. Finally, for his retirement in 29 years,

Vinayak will need Rs 10 crore, and will have to allocate his EPF, PPF, NPS,

stocks and mutual funds for this goal. He will also have to start an SIP of Rs

15,000 in a diversified equity fund and continue investing Rs 500 a year in the

PPF.

For life insurance, Vinayak has one traditional

plan of Rs 1.2 lakh and Maalde suggests he continue with it. He also needs to

buy a term plan of Rs 2.5 crore at Rs 1,834 a month.For health insurance, he

has a Rs 15 lakh plan provided by his employer. He should buy a family floater

plan of Rs 10 lakh for a monthly premium of Rs 1,167. He should also pick an

accidental disability plan of Rs 50 lakh for Rs 667 a month.